Retail Forex Markets 101

The foreign exchange market is the largest and most liquid financial market in the world. But for beginner traders, the way prices move, orders execute, and profits or losses appear on screen can feel like a black box. This blog explains how the retail forex market really works. From Forex brokers and liquidity providers to platforms like MetaTrader and cTrader.

We will also look at the role of market makers, ECN models, and how banks and hedge funds influence retail pricing. Charts included throughout will make everything crystal clear, even if you’re starting from scratch.

The Key Participants in Retail Forex

Market Makers

Market makers are brokers that quote both buy and sell prices for currency pairs. When you place an order, the broker takes the opposite side of the trade. They profit from the spread, the difference between the bid and ask price, and may hedge against your trade in the broader market if necessary.

The advantage for the Forex trader is that execution is usually instant. But because the broker profits when the trader loses, this creates a potential conflict of interest.

Liquidity Providers

Liquidity providers (LPs) are usually big banks or financial institutions that supply the pricing that retail brokers offer their clients. LPs stream real time quotes to brokers and compete with each other, which helps to keep spreads tight, especially on major pairs like EUR/USD and GBP/USD.

However, LPs can also widen their spreads or “skew” prices during volatile events or low liquidity periods, making trading more expensive for retail traders.

Prime Brokers and Prime of Prime

A prime broker offers institutional clients (like hedge funds) access to the interbank forex market and helps settle trades. Retail brokers can’t access these services directly, so they go through a “Prime Of Prime” provider, essentially a middleman that connects retail brokers to the big banks.

Retail Brokers

Retail brokers serve as the gateway between individual traders and the global forex market. They provide trading platforms, manage accounts, and handle execution. Brokers vary in their models, with some acting as market makers and others using direct market access or ECN structures. We’ll explain those next.

Forex Execution Models: How Trades Are Routed

Dealing Desk (Market Maker)

In this model, the broker acts as the counterparty to your trade. This means the broker either takes the other side of your trade or offsets it internally by matching it with another client’s order. You are not trading directly with the market.

Pros: Instant execution, fixed spreads

Cons: Potential for conflict of interest, risk of requotes or slippage during volatility

Straight Through Processing (STP)

STP brokers route your orders directly to their liquidity providers without internal dealing desks. Orders are filled at the best available price from the broker’s pool of LPs. STP brokers often add a small markup to the spread.

Pros: No conflict of interest, variable spreads

Cons: Slightly higher trading costs due to markups

ECN (Electronic Communication Network)

ECN brokers allow traders to interact with a central order book. This includes banks, other traders, and institutions. Spreads can be extremely tight (even zero), but you typically pay a commission on each trade.

Pros: Tight spreads, transparency, ideal for large volumes

Cons: Commission fees, potential for partial fills or slippage

DMA (Direct Market Access)

DMA brokers offer traders access to prices and depth directly from liquidity providers. You can choose the level at which to enter a trade, which gives more control and transparency.

How Forex Pricing Works

Bid Ask Spread and What It Means

The spread is the difference between the bid (sell) and ask (buy) price. It represents the cost of entering and exiting a trade. On major currency pairs, spreads can be less than a pip during peak hours, but they widen significantly during news events or in low liquidity sessions.

Depth of Market (DOM)

Some advanced platforms show the number of buy and sell orders at various price levels. This is known as Depth of Market. It gives you insight into where other traders are looking to enter and exit.

Slippage and “Last Look”

Slippage occurs when your trade is filled at a different price than you expected. This often happens during fast moving markets. “Last look” is a practice where LPs have a brief window to accept or reject a trade. It can protect them from toxic flow but might cause delays or rejections for the trader.

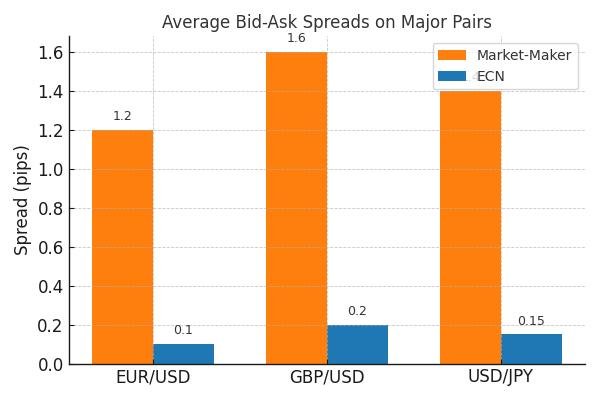

Average Spread Comparison: ECN vs Market Maker

This chart compares the average spreads for EUR/USD, GBP/USD and USD/JPY between market-maker and ECN accounts.

- Market Maker: EUR/USD spread ~1.2 pips

- ECN: EUR/USD spread ~0.1 pip + commission

Over time, even a one pip difference can significantly impact your trading costs, especially for high frequency traders.

Comparing Trading Platforms

MetaTrader 4 (MT4)

MT4 is one of the most popular platforms for retail forex traders. It’s user friendly, runs smoothly on older computers, and has thousands of free and paid custom indicators and expert advisors (EAs). However, its technology is now dated, and it lacks some modern features.

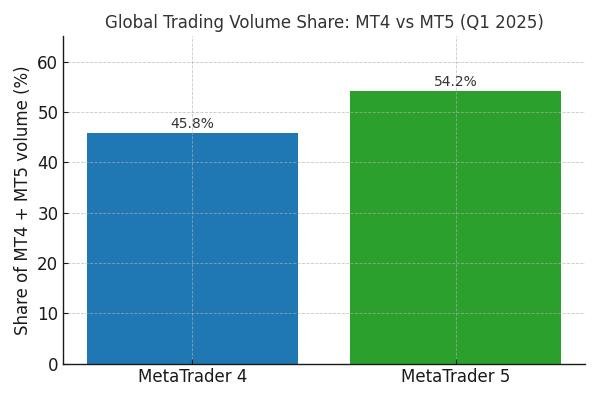

MetaTrader 5 (MT5)

MT5 is the updated version of MT4. It supports more order types, faster backtesting, and depth of market features. It’s more suitable for advanced traders and algorithmic strategies.

This chart shows that as of Q1 2025, MT5 has overtaken MT4 in terms of global trading volume, capturing 54.2% compared to MT4’s 45.8%.

cTrader

cTrader offers a more modern user interface and is especially suited for ECN accounts. It features advanced order types, integrated depth of market, and native support for C# coding. Many traders prefer it for scalping and algorithmic strategies.

How Banks and Hedge Funds Affect Retail Traders

Stop Hunting and Liquidity Sweeps

Large institutional players often know where clusters of stop loss orders are placed. They may intentionally move the market (through large order flow or quick price spikes) to trigger those stops, grab liquidity, and then reverse the price.

Quote Skewing

During periods of heavy buying or selling, banks may shift their bid and ask prices to manage risk. This can result in wider spreads for retail traders and unexpected price behavior.

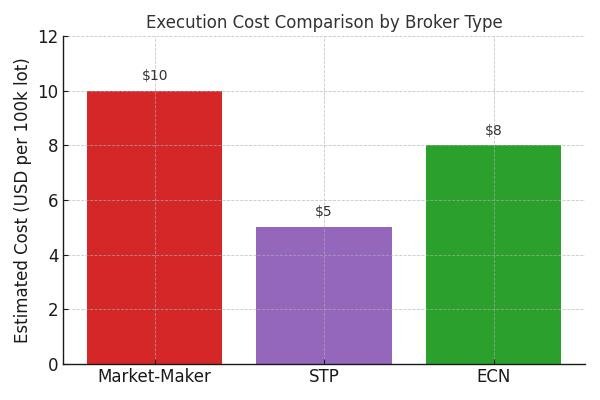

Execution Cost Comparison (Per 100k Lot)

This chart compares the total cost of a 100,000 unit (1 standard lot) EUR/USD trade under different broker models:

- Market Maker: $10 (1 pip spread)

- STP: $5 (0.5 pip spread)

- ECN: $8 (0.1 pip spread + $7 commission)

While ECNs offer lower spreads, the commission must be factored in to calculate total cost.

How to Protect Yourself as a Retail Trader

- Use limit orders instead of market orders where possible to control your entry price.

- Avoid trading immediately before or after major economic releases.

- Choose a regulated Forex broker with transparent execution policies and good slippage stats.

- Start with a small live account to experience real world execution without risking much capital.

What Happens When You Click Buy?

- You press Buy EUR/USD on your platform (MT4, MT5, or cTrader).

- The order is sent to your broker’s server.

- The broker decides how to route it, internal matching, send to LP, or place on ECN.

- The order is filled and confirmed back to your platform.

- The trade is logged and eventually cleared via the broker’s prime of prime.

All of this usually happens in under 200 milliseconds.

Retail Forex Trading in Summary

The retail forex market is a complex but exciting space. Understanding how pricing, liquidity, execution, and platforms work gives you a massive advantage. Instead of just reacting to price movement, you’ll know what’s happening behind the scenes, and why.

With the right broker, execution model, and platform, you can start trading with confidence, control your costs, and build a consistent edge in the markets.